16 in unit trust and Private Retirement Scheme PRS Trusted by more than 4 million accountholders nationwide More than 35 years of fund management experience A wholly. Gold eGold Investment Account.

Contributors are advised to read and understand the contents of the Disclosure Document of Public Mutual Private Retirement Scheme Conventional Series and Disclosure Document of.

. Under the scheme. Over 2000 new sales resales and lettings vacancies every week of retirement properties and senior housing for elderly. Like with EPF PRS contributions are also divided 7030 into two sub-accounts.

Structured Product Investment. A double income young family in mid-career or already near. Online account opening via PBe only.

Public Mutual Online Registration. Many of us in employment struggling with rising bills and prices as well as many older people on modest incomes in retirement. Over-the-counter at branch only.

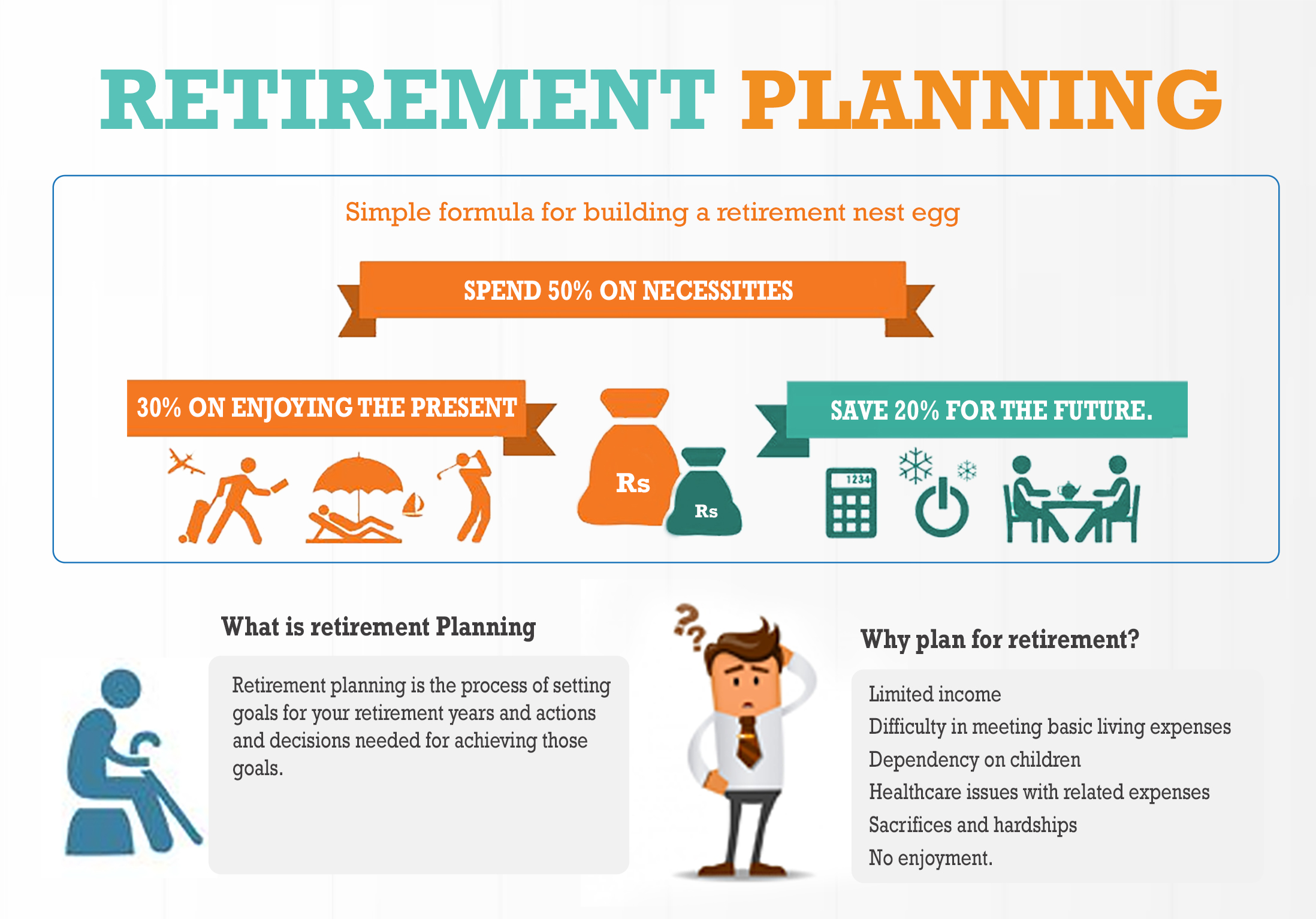

Gold purchases and sales are offered at a discounted price. PRS is a voluntary investment scheme to help you save for retirement. Explore our retirement planning calculator to estimate how much you would need to save for a comfortable retirement.

Public Bank Berhad PBB and Private Pension Administrator Malaysia PPA had officially signed the Private Retirement Schemes PRS Online FPX Service Agreement held at. Retirement properties retirement homes to rent or let in the UK. PRS is similar to the Employees Provident Fund EPF in that it is a retirement scheme.

Private Retirement Scheme known as PRS for short is a long-term savings plan which allows you to voluntarily contribute and build up your retirement fund. Welcome to the Local Government Pension Scheme. What is a Private Retirement Scheme PRS.

The Recovery Loan Scheme is currently open to businesses of any size to support them to access loans and other kinds of finance so they can recover after the pandemic and. Sub-Account A and Sub. Private Retirement Scheme PRS is a voluntary long-term contribution scheme designed to help individuals accumulate savings for retirement.

PRS seek to enhance choices available for. Public Bank Berhad 6463-H Menara Public Bank 146 Jalan Ampang 50450 Kuala Lumpur Tel. To save and invest for your retirement Public Mutual offers a wide.

Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. Public Mutual Berhad 23419-A Menara. Funds under PRS are.

03-2176 6000 2176 6666 Hotline. If you are currently working for Xerox you can find information here about the Aegon Stakeholder Pension Plan for Xerox employees The Main and AE Plans the pension. Unit Trust Private Retirement Scheme.

Private Retirement Scheme PRS - FAQs Page 3 The approach may be different if you are a single young employee. Unit Trust Private Retirement Scheme. Public Bank also distributes a wide range of PRS funds that you may choose to contribute based on your contribution time horizon risk appetite and age.

Up to RM7000 public servant or.

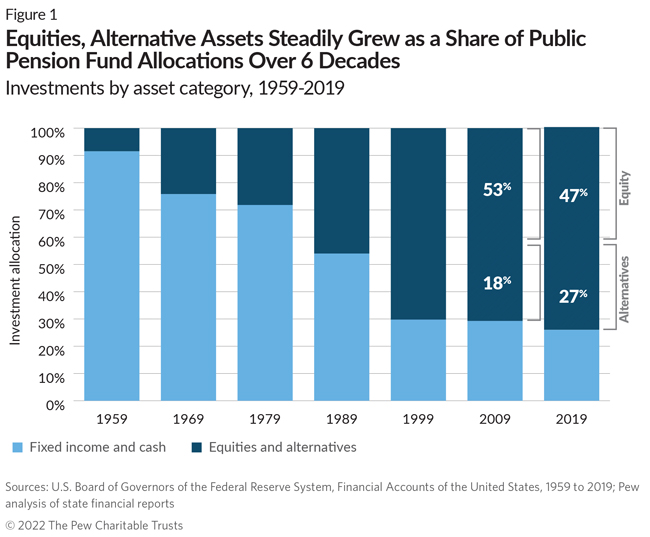

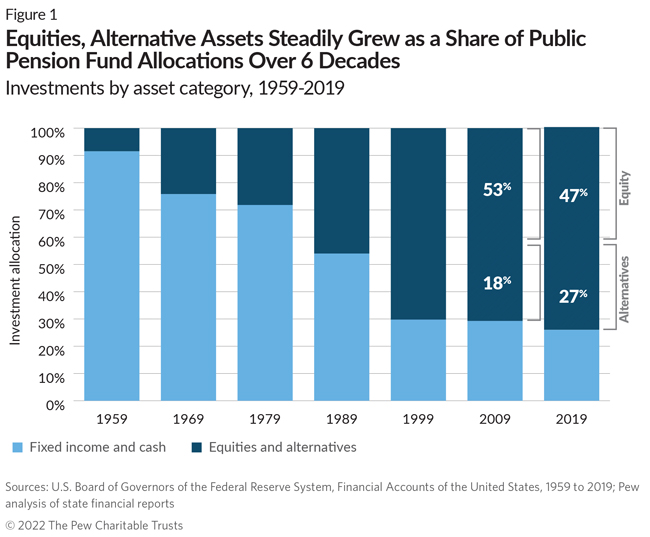

State Public Pension Fund Returns Expected To Decline The Pew Charitable Trusts

/dotdash-investmentbank_vs_merchantbank-Final-919a2920abc645518abb9c8620ae5cad.jpg)

Investment Banks Vs Merchant Banks What S The Difference

Public Bank Berhad Unit Trust Private Retirement Scheme

Occupational Pension Plan An Overview Sciencedirect Topics

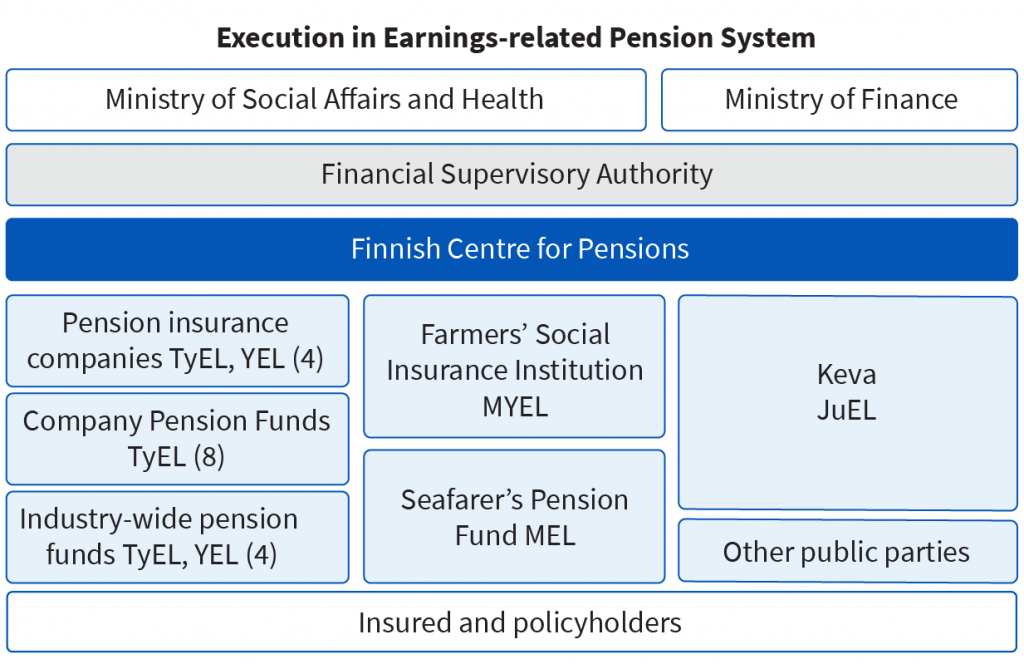

Parties To The Pension Scheme Finnish Centre For Pensions

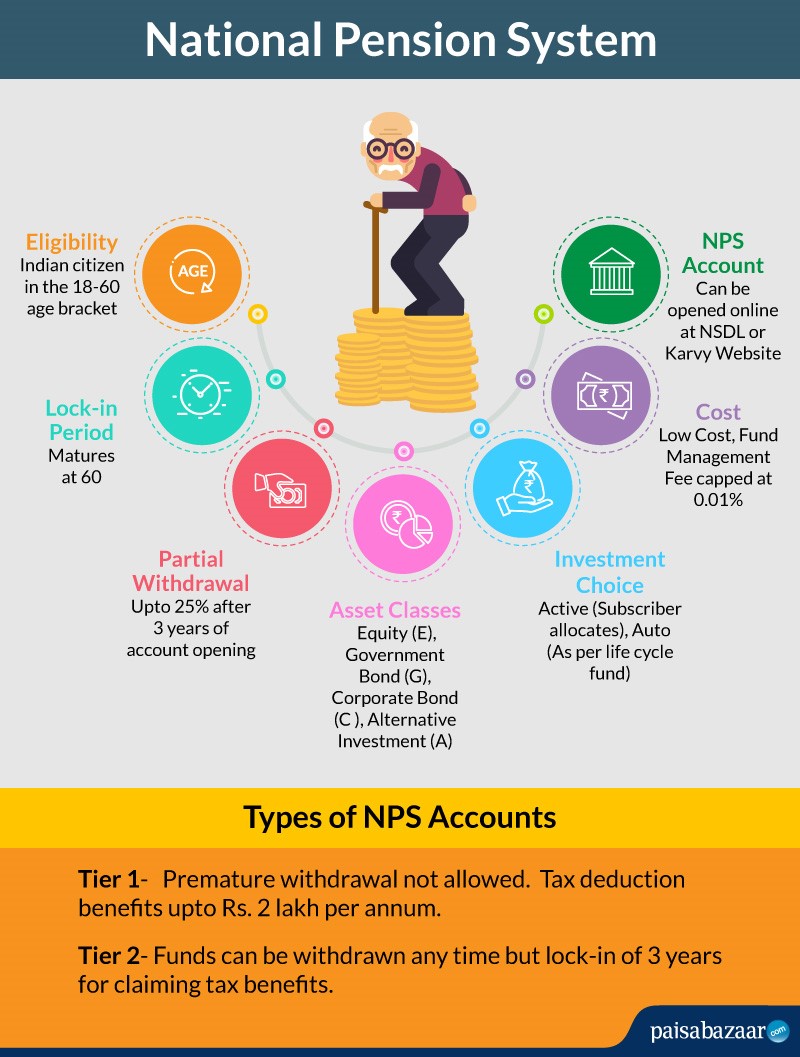

Nps National Pension Schemes Eligibility Types Calculator

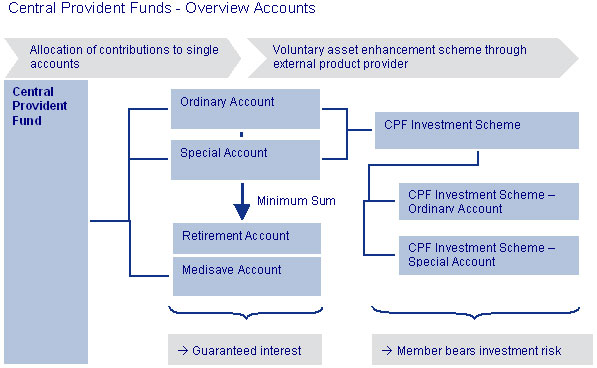

Pension System In Singapore Pension Funds Online

A Guide To The Private Retirement Scheme Prs

/TermDefinitions_Privateequity_finalv1-ad98fd624b5e490fb867b0cbc0bc782b.png)